The Need for Funding Alternatives

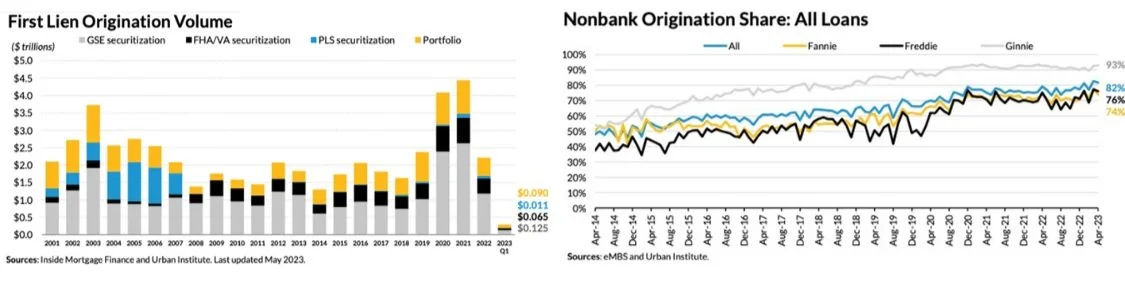

Non-bank mortgage originators account for over 80% of newly originated mortgages, which has increased the need for warehouse funding capacity. This capacity has been largely filled by regional and super-regional banks. These bank providers are pulling back from the market due to active liquidity monitoring, CRE credit concentrations, and more conservative capital management.

Regional and super-regional banks that have historically provided warehouse funding for the non-bank originator market continue to reduce commitments or exit this line of business entirely.

Well-known banks who exited the space in 2023 include Silvergate, Republic Bank, Wells Fargo, Fifth Third Bank, Comerica, Webster Bank, Bank of Hope and others. In 2024, Truist announced its possible departure from the lending space, and Flagstar Bank recently announced the sale of its warehouse lending business to JPM Chase and its IB Securitization Group.

In a recently published editorial in the Wall Street Journal (May 13, 2024) titled Janet Yellen’s New Too-Big-To-Fail Firms, the U.S. Treasury Department is suggesting that non-bank mortgage servicers should be considered systemically important institutions as well, carrying the same regulatory distinction as the large banks. In a recent report by the Financial Stability Oversight Council (FSOC), they cite the significant dependence of the U.S. housing market on non-bank mortgage servicers and originators, a material change from 2008. In the very low rate environment experienced over the past several years and excess deposits in the banking system, the warehouse lending concentration risk was not a pressing concern. However, the macro environment has now changed, and the resulting concentration risk for mortgage funding to the regional bank market is not healthy for the stability of the residential mortgage finance system in the U.S.

Warehouse spreads are widening as capacity is coming out of the system. Even with new originations expected to decline to $1.5 trillion for 2024, the need for warehouse capacity is increasing.

Problem: Warehouse Lending landscape exhibits volatility and uncertainty in the regional bank market.

What factors are driving this trend?

Concentrated credit exposures to underperforming assets such as commercial real estate against an uncertain economic and interest rate backdrop

Pending Basel III changes to increase risk-based capital requirements for mortgage-related assets

Bank boards continue to push strategy away from mortgage-related assets in support of core deposit gathering from C&I relationships; profitability pressures may drive accelerated M&A

Legacy technology and bank P&Ps result in elevated costs to deliver warehouse lending services and are slow to adopt (For example, Fifth Third Bank took over 2 years to stand up their warehouse lending business before deciding to shut it down.)

Solution: TitalCapital, a newly created, tech-forward independent warehouse lender

By utilizing best-in-class technology and more diverse funding, our goal is to deliver a more stable and predictable funding source for IMBs. TitalCapital will partner with OptiFunder for seamless integration for funding through loan sale to the capital markets.

Native integrations with OptiFunder’s Warehouse Management System for Mortgage Originators allow originators to automate the entire funding through loan sale process and reduce significant expense, minimize manual labor and errors, and shrink dwell-time.

Native integrations with Greyhound by OptiFunder allow TitalCapital to automate all aspects of warehouse lending, streamline funding, shipping, and paydown requests, and gain insights with transparent reporting.

TitalCapital will offer an additional funding source for Originators, while streamlining and automating funding through loan sale, increasing efficiencies, scalability and transparency for all.